The £1 Million Business Relief Cap: Are Your Clients Ready?

Business Relief Changes: Are Your Clients Ready?

Business Relief (BR) has long been a vital tool in inheritance tax (IHT) planning. For business owners and high-net-worth clients, it has provided a flexible, effective route to pass on wealth without the rigidity of trusts or the burden of an immediate 40% tax charge.

The upcoming £1 million cap on 100% BR and Agricultural Property Relief (APR), expected to take effect from 6 April 2026, fundamentally alters the landscape for clients with BR-heavy estates. Most clients are somewhat are aware that changes are on the horizon, but we've found that many have yet to grasp the full scale of the impact or to take steps to prepare.

This is not a minor technical tweak. It represents the most significant restriction to BR in nearly 50 years. As FT Adviser put it: “The Chancellor’s decision… will impact thousands of family businesses and landowners.”

What Do We Know So Far?

The Chancellor’s Autumn Statement in October 2024, and HM Treasury's subsequent communications in December 2024, March 2025 and May 2025, confirmed the following key points.

- From 6 April 2026, the first £1 million of combined BR and APR assets per individual or trust will qualify for 100% relief.

- Any qualifying assets above the £1 million threshold will receive only 50% relief, leaving the excess value exposed to IHT at an effective rate of 20%.

- AIM shares and other unlisted shares will no longer qualify for 100% relief; they will instead attract only 50% relief, and this relief will not count towards the main £1 million BR cap.

- The £1 million allowance will refresh every seven years, similar to the nil-rate band, but unlike the nil-rate band, it cannot be transferred to a spouse or civil partner, will not offer taper relief, and any unused allowance will be lost.

- Lifetime transfers made on or after 30 October 2024 will be assessed under the new rules if the donor dies on or after 6 April 2026. This means gifts made since late 2024 could already be caught if the client does not survive beyond April 2026.

Whilst draft legislation has not yet been published, HM Treasury has confirmed the Government intends to legislate for the cap with effect from April 2026. In our view, that means the changes should be treated as live planning considerations now, even though final details could change during the legislative process.

Why the BR Cap Matters

BR currently allows families to pass on unlimited qualifying assets free from IHT, provided certain conditions are met. Namely, the assets must have been owned for at least two years, and they must qualify as trading businesses or agricultural property.

Under the new cap, estates with significant BR-qualifying assets face substantial new liabilities.

For example, if a client has £3 million in BR-qualifying assets, the first £1 million will benefit from 100% relief with no IHT payable.

The remaining £2 million will qualify for 50% relief, leaving £1 million effectively exposed to 40% IHT, which results in an IHT bill of £400,000. In other words, the excess above the cap will be subject to IHT at an effective rate of 20%.

This tax liability could force the sale of shares, farmland, or even the family business. This is precisely the situation BR was designed to prevent when it was introduced as Business Property Relief (BPR) back in 1976.

As STEP rightly warns: “Relying on Business Relief alone will no longer be sufficient to fully mitigate inheritance tax liabilities once the cap comes into effect.”

How the £1 Million Cap Affects Lifetime Gifts

A critical but often overlooked point is the timing of lifetime gifts.

Gifts made before 30 October 2024 benefit from the existing unlimited BR if the donor survives seven years. Gifts made on or after 30 October 2024 will fall under the new cap and limited relief if the donor dies on or after 6 April 2026.

Given the window to make pre-30 October 2024 gifts has already closed, any gifts made since that date will be assessed under the new BR rules if death occurs on or after 6 April 2026.

Advisers should now focus on reviewing recent gifts, modelling exposure under the upcoming £1 million cap, and exploring alternative strategies to manage potential IHT liabilities.

Common Misunderstandings About the New Rules

Discussions with advisers often reveal their clients have a number of misconceptions.

- Some believe AIM shares will continue to qualify for 100% relief. They will not. From April 2026, AIM shares will only qualify for 50% relief and will not count towards the £1 million cap.

- Some assume spouses can share the allowance like the nil-rate band. They cannot. The £1 million allowance is individual or per trust and cannot be combined or transferred.

- Others think they can simply gift everything before death to avoid the cap. Any gifts made on or after 30 October 2024 will fall under the new cap if the donor dies on or after April 2026.

- There is also a misconception that splitting assets into multiple gifts will create multiple £1 million caps. It will not. There is a single £1 million allowance per individual or trust, and multiple gifts do not multiply the cap.

The Bottom Line

Whilst it is undoubtedly challenging to plan with absolute certainty before legislation is published, the policy direction from government is clear. The confirmed intention to impose a cap represents a fundamental shift in how many estates will be taxed from April 2026.

The consultation on these proposals is already closed, and a very brief "summary of responses update" was issued in May 2025, with the first draft of legislation expected in the coming months. This of course means there remains a possibility that technical details could change before the final legislation is enacted. However, given the explicit statements in the Autumn Statement and subsequent HM Treasury briefings, it is prudent for advisers and clients to work on the basis that these rules will come into force as outlined.

The window of opportunity to prepare is narrowing. Early planning allows time to review existing arrangements, model potential liabilities, and consider alternative strategies. Leaving this until draft legislation is published risks running into a last-minute rush, with limited time to implement meaningful changes before the cap takes effect.

As the saying goes, failing to plan is planning to fail. Firms should therefore take proactive steps now to ensure their clients’ estate plans remain robust, tax-efficient, and aligned with what is set to be the most significant change to Business Relief in nearly half a century.

Technical Planning Considerations

There are a number of potential complementary solutions on the table, but it’s important to remember that no single strategy will be right for every client. Advice needs to be tailored to individual circumstances, objectives, and risk risk profile (as always!)

- Advisers should start by considering whether BR assets are best kept in personal names, gifted into discretionary trusts, or moved into a Family Investment Company (FIC). FICs in particular can be a powerful option for those with significant estates, giving greater control and flexibility. I’ll be publishing a blog focusing on how FICs can fit into estate planning in the coming weeks, so keep an eye out for that.

- Using multiple discretionary trusts can stagger gifts over different seven-year periods, potentially allowing refreshed allowances over time. But it’s essential to factor in trust charges which can apply at the start, during the life of the trust, and again on exit, as well as the possibility of anti-fragmentation rules limiting the effectiveness of multiple trusts. These points should become clearer once the technical consultation concludes.

- It’s also worth reviewing how assets are structured. Segregating qualifying assets can help ensure the £1 million cap is applied to the most valuable or tax-efficient parts of the estate.

- For clients unwilling or unable to gift assets outright, Whole of Life policies held in trust can provide much-needed liquidity to cover any IHT due on assets above the cap, avoiding a forced sale of family businesses or land.

- Discounted gift trusts, flexible reversionary trusts, or loans to trusts can all sit alongside BR strategies to create a more resilient, diversified plan.

- Finally, accurate and detailed records are key. Keeping evidence of asset valuations, ownership periods, and qualification status will be vital to support BR claims and minimise the risk of challenges from HMRC once the new rules take effect.

Steps Advisers Can Take Now to Be Prepared

- Identify BR-heavy clients and review your client base to pinpoint those with qualifying assets above £1 million.

- Model tax exposure by calculating potential liabilities under the new rules for each affected client.

- Review wills and trusts to ensure they align with the new regime and facilitate efficient asset distribution.

- Rethink AIM strategies and evaluate the suitability of AIM investments for IHT planning given the loss of 100% relief.

- Use alternative solutions such as flexible trusts, discounted gift schemes, or Family Investment Companies alongside BR strategies.

- Communicate clearly so clients understand these changes. Early, proactive conversations will avoid unpleasant surprises later.

How ParaPlan Pro Can Help

At ParaPlan Pro, we provide far more than report writing.

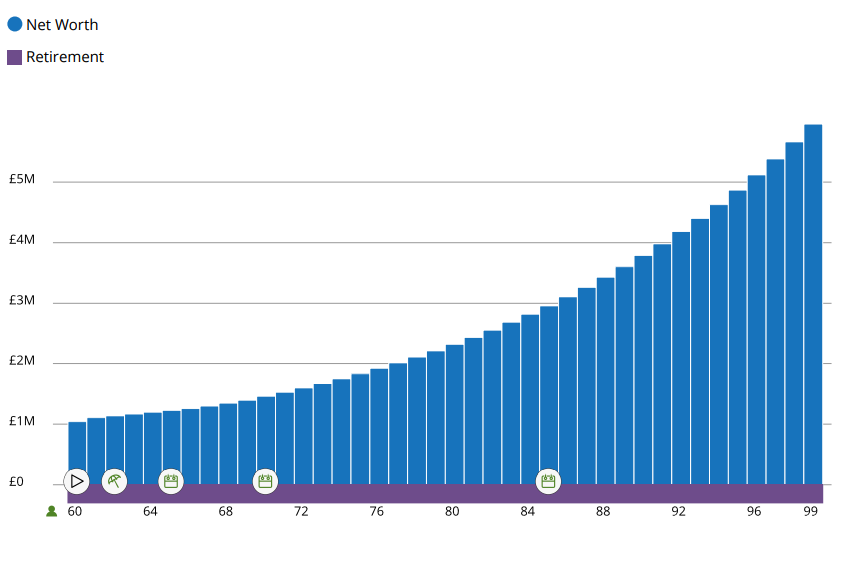

We partner with advisers to build robust, forward-thinking strategies that stay ahead of evolving legislation. We can model client exposure under the new BR cap, draft clear communications explaining the changes and their implications, provide technical support on BR eligibility, and help create comprehensive estate plans that integrate BR with other effective solutions.

The new BR cap doesn’t mark the end of tax-efficient estate planning, but it does mean advisers can no longer rely on BR alone. Acting now is key to protecting clients from unexpected tax liabilities and preserving family wealth.

If you’d like support reviewing plans, preparing client communications, or restructuring strategies to meet these changes with confidence, we’d be delighted to help. Please get in touch using the button below to arrange a free, no-obligation chat.