Family Investment Companies: Practical Planning in a Changing Landscape

Understanding the benefits, pitfalls, and practical considerations...

With the £1 million cap on Business Relief (BR) and Agricultural Property Relief (APR) set to land in April 2026, advisers and clients alike are rightly looking for complementary ways to plan effectively for the next generation.

One solution that keeps cropping up in conversations is the Family Investment Company (FIC), and with good reason. FICs offer a compelling alternative or addition to traditional trusts, particularly for clients with significant assets who want to retain control over investments, pass on value tax-efficiently, and maintain flexibility for decades.

However, like any planning strategy, they’re not suitable for everyone, and understanding both the opportunities and limitations is key.

What is a Family Investment Company, Really?

Put simply, a Family Investment Company is a private company, usually limited by shares, established to hold and manage family wealth. The typical setup sees parents or grandparents acting as directors, maintaining day-to-day control, while different share classes can be used to pass growth, and eventually capital, to children or trusts over time.

FICs can invest in a range of assets, including equities, funds, bonds, or even property, with income and gains taxed under corporation tax rates rather than at personal income tax rates. This can result in significant tax savings over time, particularly for clients with larger portfolios who might otherwise face income tax of up to 45% on investment returns held personally.

An Example:

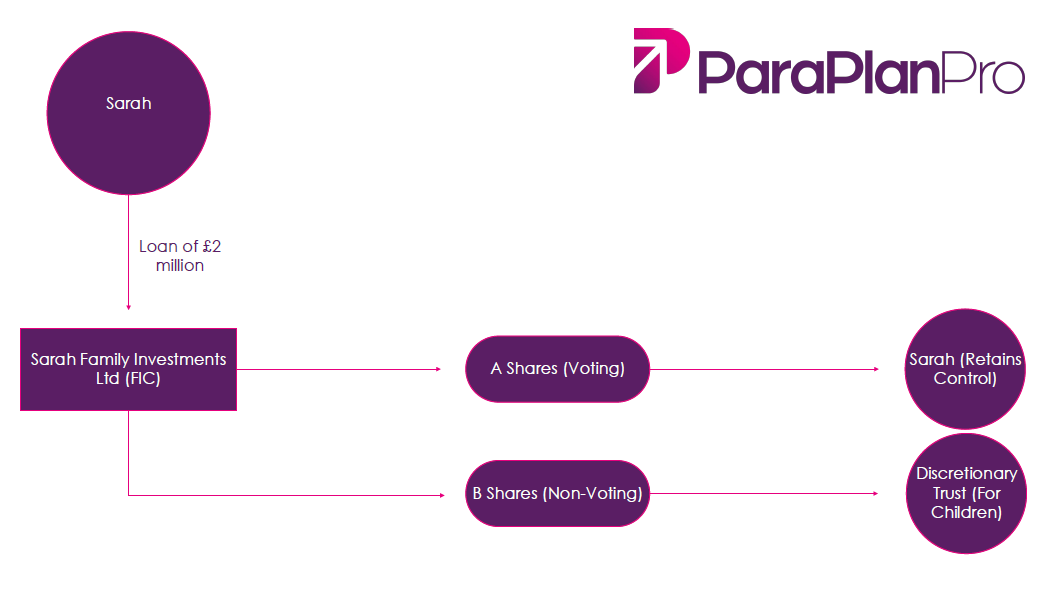

Take Sarah, who has sold a business and wants to invest £2 million for her two children whilst retaining full control of her capital. She establishes Sarah Family Investments Ltd with two share classes:

- A Shares – Voting shares held by Sarah, giving her control of the FIC’s decisions.

- B Shares – Non-voting growth shares issued to a discretionary trust for her children’s benefit.

Sarah subscribes £1 for her A shares, and the trust subscribes £1 for the B shares. She then loans £2 million into the FIC to fund investments. The loan can be gradually repaid to Sarah tax-free, providing a flexible and efficient way to supplement her income over time.

As the FIC’s assets grow, the increase in value accrues mainly to the B shares, outside Sarah’s estate for IHT purposes (assuming she survives 7 years). Dividends paid on B shares can be used for the children’s needs or retained in the trust. Note, however, that any dividends received by individuals are taxed as income. Meanwhile, Sarah retains decision-making power via her A shares.

Visualising the Structure:

Why FICs Are Gaining Popularity

FICs provide a flexible way for families to plan intergenerational wealth transfers whilst at the same time retaining control over assets and investment decisions. Unlike discretionary trusts, which are subject to 10-year periodic charges and limits on contributions, FICs can accumulate and reinvest income indefinitely without these charges.

Profits are taxed under the corporation tax regime, as follows:

| Profit Band | Corporation Tax Rate (25/26) |

|---|---|

| Up to £50,000 | 19% |

| £50,000 - £250,000 | Marginal relief applies |

| Over £250,000 | 25% |

When FICs Make Sense

FICs can be particularly useful for:

- Clients with significant liquid assets (e.g. proceeds from a business sale or a significant windfall).

- Families looking to plan beyond the new £1 million BR/APR cap.

- Those wanting to maintain investment control while gradually reducing their estate.

- Families concerned about future protection of assets from third-party claims.

- Clients who value privacy and are comfortable with the additional considerations of unlimited liability.

- Clients familiar and comfortable with corporate governance requirements, such as annual accounts, Companies House filings, and corporation tax returns.

Potential Downsides of Using a FIC

As with any good piece of planning, it’s important to weigh the potential downsides carefully:

- Tax rates - for substantial profits, corporation tax is 25%, which may impact returns depending on investment performance.

- Professional fees - legal setup, ongoing accounting, and compliance advice can be costly.

- Compliance - annual filings with Companies House and HMRC are mandatory. FICs suit families willing to engage long-term with these requirements.

- Dividend taxation - dividends paid to individuals or trusts are subject to income tax, with trustees generally taxed at the additional rate. That said, through careful planning and timing, particularly where beneficiaries are non- or basic-rate taxpayers, there’s often scope to reduce the overall liability.

- Loan repayment pitfalls - repayments beyond the original loan amount could be deemed distributions and taxed accordingly.

- Capital Gains Tax (CGT) - share transfers to trusts may trigger CGT unless exempt. Investment companies do not qualify for hold-over relief.

- HMRC scrutiny - whilst FICs are legitimate, their use has attracted attention. A dedicated HMRC team previously investigated their use and found no widespread abuse, but genuine commercial rationale and robust documentation remain essential.

Keeping Things Private

Another common concern when structuring family wealth within a limited company is the lack of confidentiality. Annual accounts must be filed with Companies House, making financial information publicly accessible.

To address this, some families opt to establish their FIC as an unlimited company, which offers a substantially greater degree of privacy. Unlimited companies are not required to file annual accounts publicly, effectively shielding details of assets, investments, and income distributions from public view.

This can be particularly appealing to clients who value discretion, such as high-profile individuals or families keen to avoid media attention or third-party scrutiny.

That said, unlimited companies carry unlimited liability, meaning shareholders are personally responsible for any debts or obligations the company incurs. For that reason, they are only suitable where the financial risks are clearly understood, managed within agreed parameters, and proportionate to the shareholders’ personal capacity to absorb liability.

Many families remain comfortable using this structure, particularly where they have confidence in the underlying investments and clarity over potential exposures, but ultimately, it’s vital to balance confidentiality against financial vulnerability, and as ever, professional advice should be sought!

How FICs Fit Alongside BR

For clients with BR-qualifying assets above the new £1 million threshold, FICs can shelter non-BR assets in a more controlled, tax-efficient environment. They can also manage surplus proceeds from the sale of a business or investment property, reducing personal estate values over time.

Combined with other strategies, including trusts and suitable Whole of Life protection, FICs can form a key part of a more comprehensive estate planning strategy, particularly in light of the changing BR landscape, provided it is done right!

The Bottom Line

FICs aren’t a one-size-fits-all solution, but for the right clients they can be a powerful way to control and pass on wealth tax-efficiently.

A well-structured FIC can give families confidence that their assets are protected, aligned with long-term goals, and where appropriate, kept private.

How ParaPlan Pro Can Help

Whilst the design and implementation of a Family Investment Company should ultimately rest with a suitably experienced corporate tax adviser, we have substantial experience supporting advisers and families who utilise this type of structure for a range of strategic purposes.

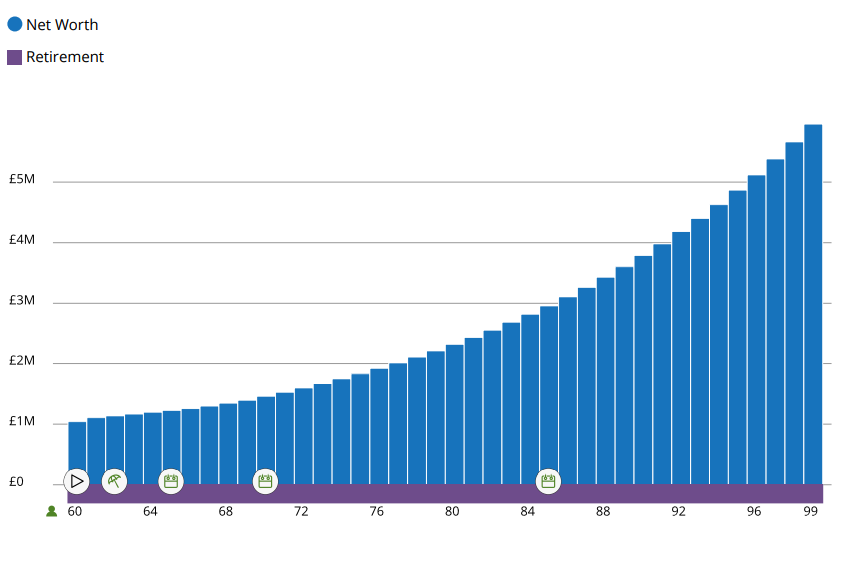

We can help you model the tax implications of a FIC compared to more traditional approaches, and provide clear, practical insights to help your clients understand the benefits and trade-offs involved.

We also work alongside a panel of experienced tax and legal professionals who share the same commitment to high-quality, client-focused advice. By collaborating from the outset, we can make sure everything is structured correctly and tailored to your clients’ specific needs, avoiding costly mistakes later on.

If you’d like support exploring how FICs could fit into your estate planning proposition, or simply want to discuss a particular case, we’d be delighted to help. Please feel free to click the button below to arrange a free initial chat.