Keep It in The Family or Call in The Cavalry?

To outsource or not to outsource... that is the question!

For many firms, the choice between building an in-house paraplanning team and outsourcing the work isn’t straightforward.

Both have their merits. But the right approach depends on your business model, case mix, resources – and increasingly, your appetite for cost and risk.

I’ve worked with firms that do both. Indeed, I was an in-house paraplanner for many years before launching my own company. And through ParaPlan Pro, I now support a wide range of firms that have made the decision to outsource.

Here’s how I see it…

Flexibility vs Fixed Overheads

When you hire in-house, your paraplanning resource is a fixed cost, regardless of how busy you are.

Salary, pension contributions, National Insurance, ongoing training, equipment, software licences, and office space all add up. For a good paraplanner, that’s typically:

- Salary: £40–50k+ depending on location and experience

- Employer NI & pension: 15–20%

- Ongoing CPD & exam support: £1–2k p.a.

- Recruitment fees (if applicable): 15–20% of salary

- Software & licences: £1–2k p.a.

And that’s before factoring in management time, performance reviews, holiday cover, and (inevitably) turnover and replacement costs.

Paraplanner Today reported in its 2023 survey that nearly 40% of firms found it increasingly difficult to recruit and retain experienced paraplanners, citing rising salary expectations and greater demand for flexible working. That’s before you get to the highly competitive and rather shallow talent pool.

With an outsourced model, you only pay for what you need. That can be scaled up or down as your workflow demands, without carrying fixed cost and resourcing risk.

Breadth of Expertise

A strong in-house paraplanner can be an invaluable asset. But one individual can’t specialise in everything.

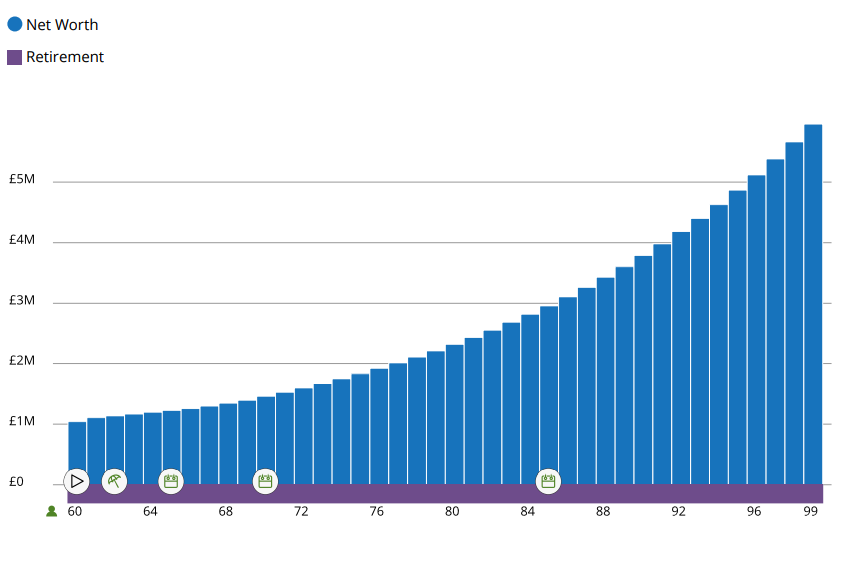

From cashflow modelling and complex estate planning to legacy pension schemes and niche investment products, the technical knowledge required today is vast. Outsourced firms (good ones, at least) typically support a range of advisers and advice types, which gives them exposure to technical areas your internal resource may rarely encounter.

FT Adviser highlighted in a 2024 article that increasing case complexity is driving demand for paraplanners with multi-disciplinary knowledge, particularly around cashflow modelling, lifetime allowance changes, and international planning.

It’s also worth noting that many outsourced paraplanners bring their own tech stack. Tools, templates, and everything in between, that can dramatically improve turnaround times and consistency. If your in-house team is still reliant on manual processes or basic templates, these efficiency gains can be a real bonus. Particularly given the constant churn of regulatory change.

That doesn’t mean outsourcing is always “better,” but it can give you access to wider experience and additional capacity when cases demand it.

Resilience & Continuity

It’s a familiar story: one strong paraplanner leaves, and the firm suddenly finds itself exposed.

Recruitment takes time. The market for experienced paraplanners is competitive. And even when you do hire well, there’s always a bedding-in period.

Outsourced paraplanning offers greater resilience. You’re not reliant on a single employee, and you’re not left scrabbling if someone resigns or goes on long-term leave.

There’s a compliance advantage too. Good outsourced paraplanners are already up to speed with the latest rules – from Consumer Duty and PROD to shifting pension legislation. This takes pressure off your internal processes and gives you peace of mind that reports are accurate, consistent, and aligned with current regulations.

Cost Comparisons: What’s the Real Picture?

Let’s take a simple example.

- A good in-house paraplanner on £45k base salary will typically cost £55–60k p.a. once you factor in employer NI, pension, CPD, software, and a share of management overhead.

- Add recruitment and turnover costs over time and that rises further.

Compare that with a pay-as-you-go outsourced model, where you only incur cost when you need capacity, whether that’s one report a month or consistent support across multiple advisers.

For small to mid-sized firms, the numbers often favour outsourcing, especially where case volumes are variable or unpredictable.

For larger firms with steady, consistent demand, a hybrid approach (strong internal core + outsourced flex) can often deliver the best of both worlds.

Control & Cultural Fit

One of the most common concerns firms raise about outsourcing is control.

- Will the reports feel like “ours”?

- Will the tone of voice match?

- Will it disrupt our advice process?

The short answer: it shouldn’t.

At ParaPlan Pro, we integrate seamlessly with each firm we work with. We take the time to understand your preferences, your templates, your style – so what we produce looks and feels like an extension of your own team.

In many ways, the result is the same. But you don’t carry the overhead, risk, or management burden of maintaining it in-house.

Final Thoughts

There’s no one-size-fits-all answer.

But if your firm is growing, your case complexity is increasing, or your internal resource is stretched, it’s well worth exploring whether outsourcing could give you the flexibility, expertise, and resilience you need.

And if you’re planning for growth, outsourcing can help you scale sustainably – giving you extra capacity when you need it, without the pressure of hiring reactively or overextending your internal team at a significant cost.

If you’d like to understand how it works or benchmark the costs against your current setup, we’d be happy to help. Click the button below to arrange a free, no-obligation chat.